Investment Window Closed. Not Currently Accepting New Investors

Blue Fusion Private Equity Fund

Fund 1: Villas Espavel

Blue Fusion Capital’s first property illustrates the types of assets we look to bring into the portfolio. Fun. Desirable. Luxurious. And most importantly, an asset we consider to have high-profit potential. Located in a stunning, tourism hotspot with world-class amenities for vacationers looking for a once-in-a-lifetime experience, Villas Espavel is a thoughtfully designed set of six vacation Villas located in Playa Samara, Costa Rica.

LEARN MORE ABOUT VILLAS ESPAVELVillas Espavel is Six well appointed and modern villas for families, explorers, and considerate travelers in Samara, Costa Rica.

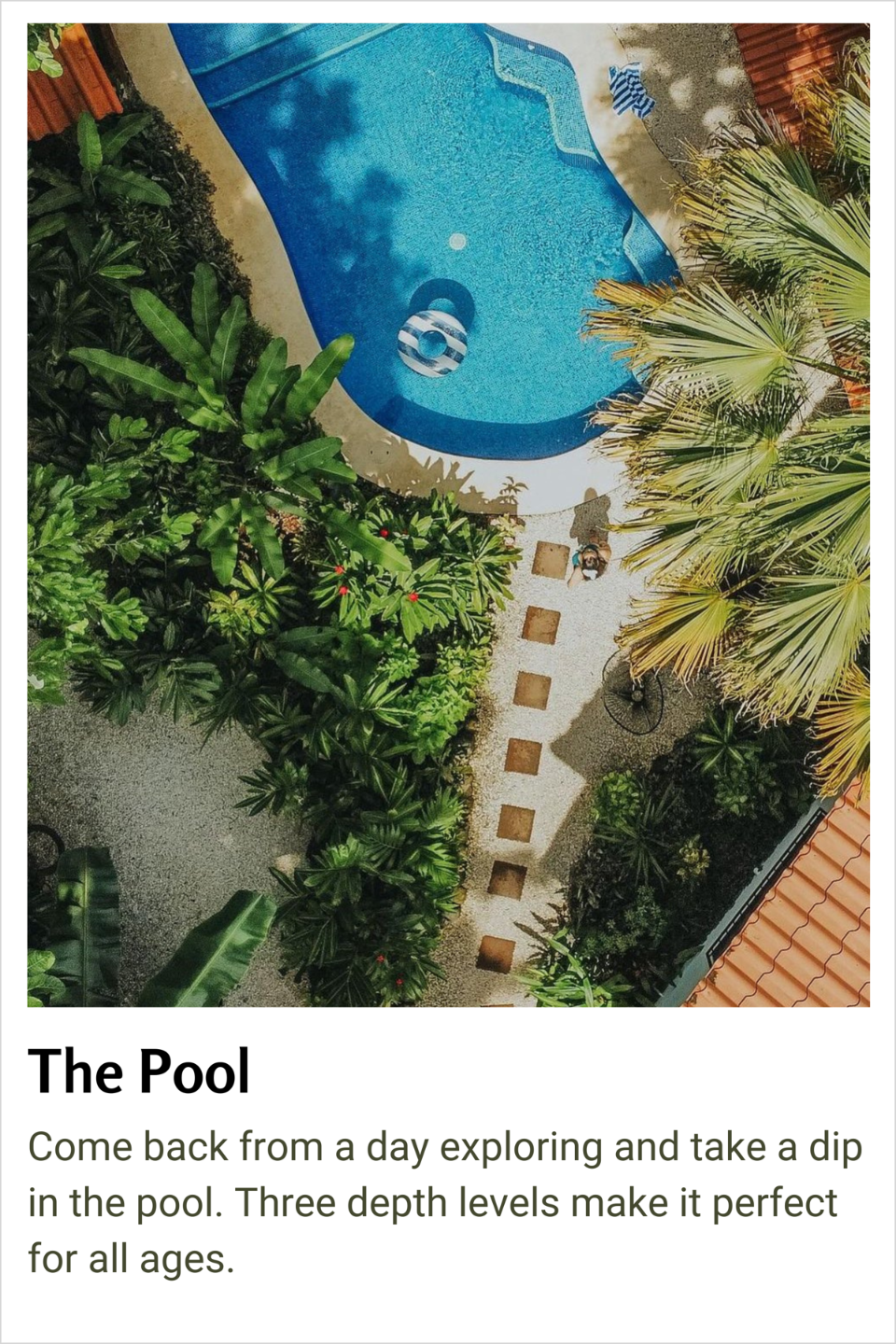

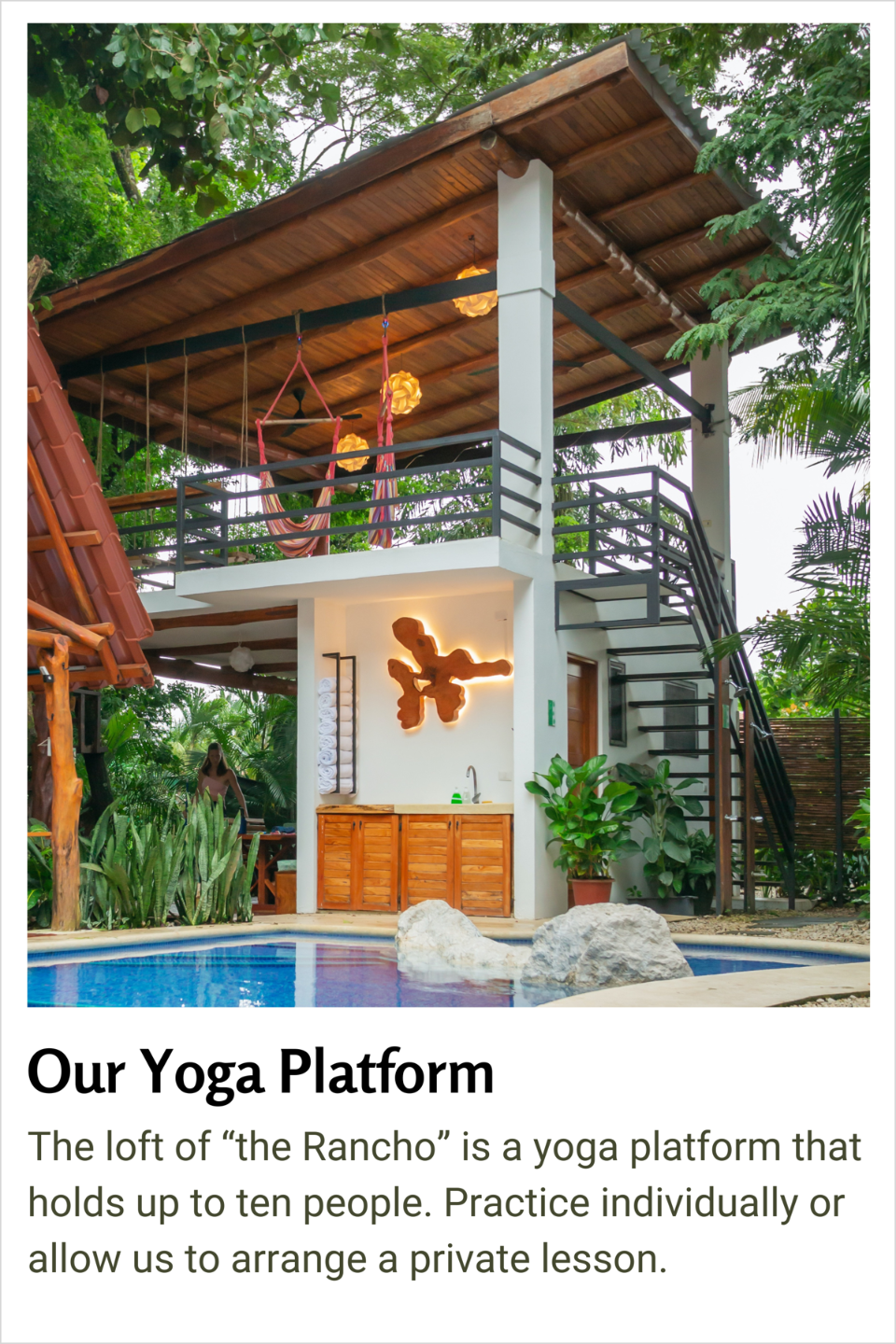

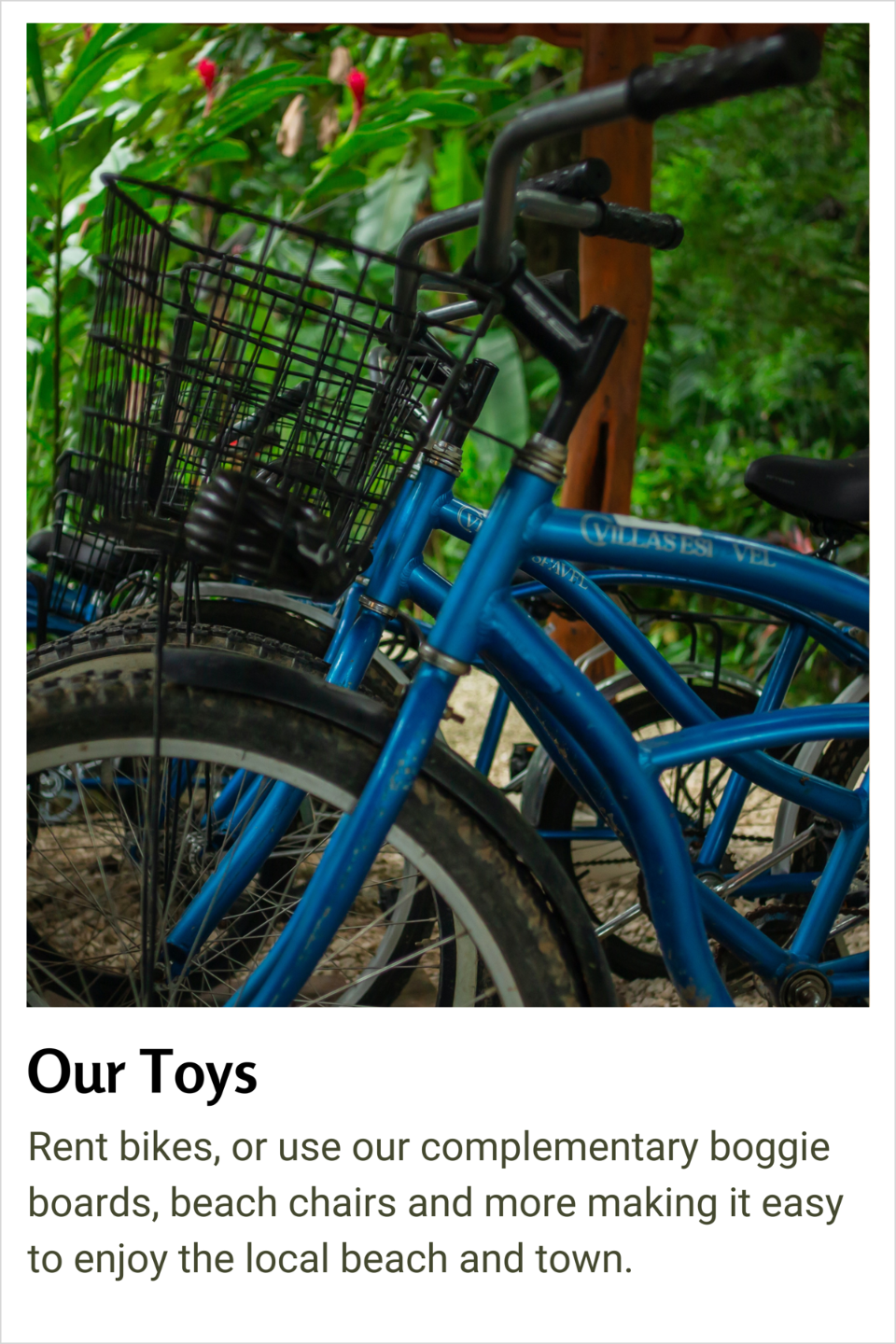

Villas Espavel is a thoughtfully designed set of six vacation villas located in Playa Samara, Costa Rica. Each of the villas includes a complete kitchen, air conditioning, a patio to relax under the jungle shade, and orthopedic mattresses for a good night’s sleep. Villas Espavel is an easy 5-10 minute walk or few minute bike ride to Playa Samara and the town center. Leave the hustle and bustle behind and feel Costa Rican "puravida" while swaying in your hammock serenaded by the songs of the jungle.

Staying at Our Properties is a VIP Experience

Every visit to our properties is an opportunity to create a once-in-a-lifetime memory for our guests. With luxury amenities and elite service at an extraordinary location, our mission is to turn guests into repeat customers who want to keep coming back. We go above and beyond to manage, and maintain our properties.

Working Relentlessly on Fundamentals and Performance

CONTACT US